Institutional-Caliber Energy Fund at $100K Minimum

Pumps and Pumps is pleased to present Iron Horse Energy Fund I, a $100MM diversified

oil & gas fund designed to deliver monthly cash flow and substantial tax advantages

for accredited investors at 10% of the normal minimum investment.

This fund provides investors with participation in production revenues,

along with full access to the powerful tax benefits of U.S. energy investments.

To Attend Our FREE LIVE

Master Class in Investing Oil & Gas

👇

| ABOUT PUMPS AND PUMPS

Why Consider Oil & Gas?

Discover the powerful advantages of strategic oil and gas investments in your portfolio

Extremely High Demand

Global energy demand continues to grow while supply lags. In fact, we're operating at a 5 million barrel/day deficit.

The world energy supply, as of 2024 is comprised of 30% oil and 23% natural gas, which means this demand is healthy.*

*According to IEA, Global Energy Review 2025 and Visual Capitalist

Unparalleled Tax Advantages

Potential to Offset ANY income: W2, Active, Passive, Capital Gains

Deductions include intangible drilling costs, tangible drilling costs and depletion allowance, which is considered one of the most attractive benefits to oil and gas investors. The depletion allowance excludes 15% of all gross income and production from revenue tax.

Smart Money is Flowing Into U.S. Oil & Gas

Warren Buffett has invested $28+ Billion into Occidental Petroleum (OXY) since 2022. Canadian Pension Funds & Sovereign Wealth Capital resumed investments in North American Energy Infrastructure.

Inflation Hedge & Long-Term Monthly Income

Oil and gas historically outperforms during inflationary periods. Estimated return of your initial investment will be in 2.5-3 years with a 2.0-3.5X multiple, depending on the price of oil and production of the wells.

You'll receive monthly income for the lifetime of production, we plan on selling after 7 years depending on the level of oil and current market conditions.

WHY US?

Institutional-Caliber Energy Fund at

$100K Minimum

We are Partnered with Iron Horse Energy

Iron Horse Fund I is a 506(c) energy fund targeting proven oil and gas assets with projected 2x–3.5x returns. It typically requires a $1M minimum—until now.

Pumps & Pumps Fund I gives accredited investors access to the same institutional-grade opportunities for just $100K via a fund-of-funds feeder structure into Iron Horse.

We don’t dilute quality. We democratize it. This is access—without compromise.

Get Monthly Income and Return of Capital Quickly

Projected cash flow begin in Q1 of 2026.

Capital is targeted to be returned in 2.5-3 years, with upside through year 7, conservatively.

In general, most oil is produced in the first years of the life of the well and then gradually dwindles. In turn, this means that the majority of your investment and potential returns will occur within the first few years.

All figures and estimates will depend on oil price and production of the oil wells.

The Problem with Traditional Oil & Gas Investing

Most individual investors are priced out of the biggest oil and gas projects. The largest operators rarely open their projects to outside participation, and when they do, buy-in typically requires seven-figure commitments.

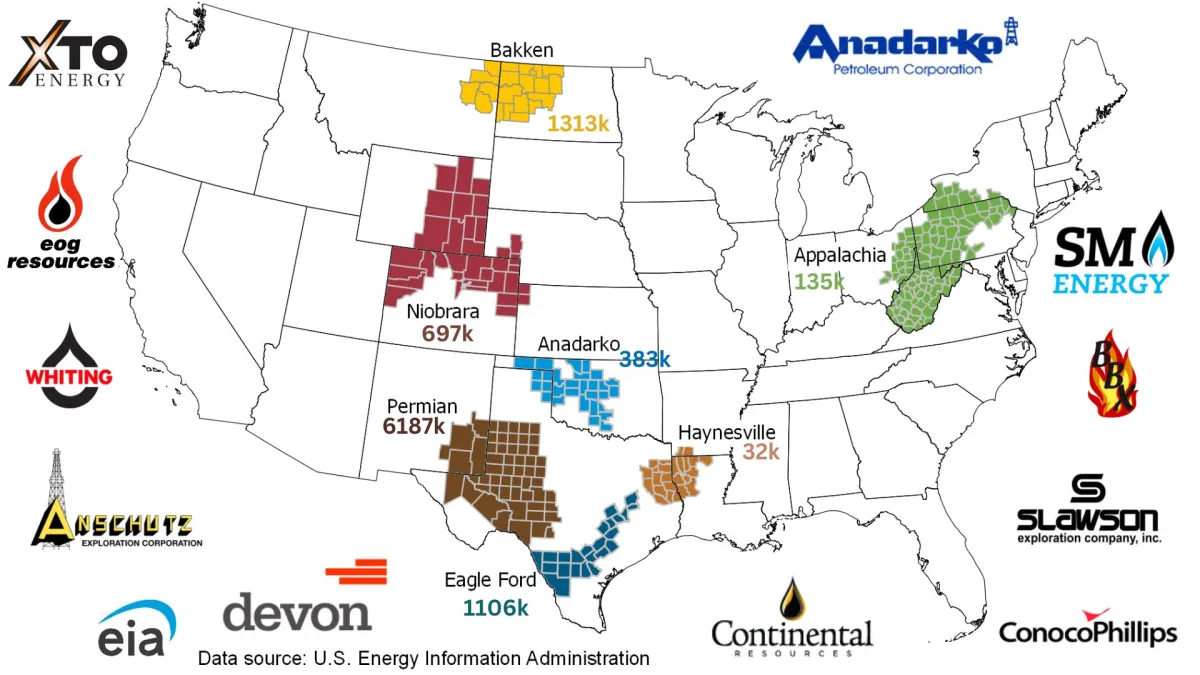

Iron Horse Fund I offers a rare alternative: direct access to projects run by elite operators such as EOG, ConocoPhillips, and Continental Resources, where the operators themselves carry the majority of the risk and capital.

While the typical oil and gas investor is tied to just 1–3 wells, leaving them exposed to a boom-or-bust outcome, Iron Horse Fund I will participate in 50–100 wells, diversified across the world’s most established operators.

Fund Management with Investor-Focused Intent

As full-time fund managers and private investors, our team built Pumps & Pumps to put capital efficiency first.

We don’t spray capital across random wells. We allocate intentionally—targeting yield, principal return, and downside protection.

Our Solution – The Pumps & Pumps Structure

We created a fund-of-funds to unlock high-barrier energy access for smart, accredited investors.

You gain diversified exposure to 50-100+ Iron Horse wells through a single $100K allocation—fully managed, fully transparent, fully aligned.

Operated by Experts. Built by Investors.

Iron Horse is led by Courtney Moeller, a disciplined oil & gas fund manager known for sourcing wells in tier 1 locations with high success rates.

Pumps & Pumps was created by seasoned investors and fund managers from Private Equity, Venture Capital, and family offices who built the fund they wanted to invest in themselves.

Start Here To Gain Access to Our Portal & Project

Fill out the form below to learn more about Pumps and Pumps investment opportunities.

THE IRON HORSE ENERGY FUND DELIVERS RESULTS

Our Proven, Winning Strategy

Partner with Major Operators

Public and Private

Most investors will never get the opportunity to participate in these types of projects with these operators.

Only Participate in Top Producing Areas

Like Permian, Eagle Ford, Anadarko, Niobrara and Bakken, to name a few.

Diversification of Investment in

50-100+ Newly Drilled Wells

We mitigate that risk by investing smaller amounts in a large number of wells.

METRICS THAT MATTER

KEY RISKS & MITIGATION

Meet The Team

Courtney Moeller

Fund Manager of Iron Horse Fund I

U.S. Navy veteran and second generation oil and gas entrepreneur with $40M+ in AUM and 100+ wells drilled across the Permian, Bakken, DJ, and Powder River basins. Known for pairing operational excellence with investor-first structuring, Courtney specializes in tax-advantaged energy investments built for cash flow, downside protection, and institutional-quality execution.

Catherine Bell

President of Titan Impact Group

President of Titan Impact Group, specializing in values-aligned investments that generate passive income across mobile home parks, medical office spaces, debt validation funds, and oil & gas. A 5x international bestselling author and educator in AI-driven capital raising, Catherine pairs wealth strategy with purpose, helping investors achieve cash flow, tax efficiency, and lasting impact.

Tracey Gore

Fund Manager at Infinite Wealth Collective

Fund Manager and licensed financial professional with 16 years of experience guiding oil and gas companies through environmental compliance, including SPCC Plans, Flow-line Contingency Plans, and Tier II Reporting. Also active as a real estate investor, I specialize in structuring passive income strategies that empower clients to build durable wealth and multi-generational legacies.

Katie Kim

CEO of The Kim Group

Third-generation developer and CEO of The Kim Group with 30+ years leading multimillion-dollar real estate projects across the U.S. Known for structuring public-private partnerships and economic incentives that reduce risk and unlock value. Katie specializes in investor-aligned development strategies built for profitability, downside protection, and institutional-quality execution.

Megan Young

Founder of Nova Skye Capital

Commercial real estate specialist focused on sourcing exclusive off-market multifamily transactions and structuring capital solutions across debt, equity, and private equity.

With deep industry relationships and experience facilitating large-scale deals, I connect sellers with institutional funds and investors seeking Class A and B properties, delivering trust, transparency, and execution in every partnership.

Laura Miller

Owner and Manager of LDM Properties LLC

Since 2005, She has managed the acquisitions and management of a $2.5M portfolio of single family rental properties nationwide. As the Portfolio Manager at Titan Impact Group LLC (since Aug. 2020) she oversaw the acquisition and management of non-performing (1st lien) residential and commercial notes across multiple states. A University of California, Davis alumnus, she also specializes in note and REO wholesaling, private money lending, and real estate development. She is passionate about creating win-win-win scenarios for borrowers, lenders, renters and investors, and assists clients with self-directed IRA vehicles for enhanced returns.

Emily Milner

CEO of M3M.Media

Brings a track record of managing six-figure digital ad budgets across hundreds of businesses with disciplined ROI accountability.

At M3M and Pumps & Pumps, she applies this performance-first approach to investor communications, integrating data-driven strategy with transparent reporting to strengthen trust, align outcomes, and deliver lasting value to limited partners.

Nika Roback

Founder of Replenish Financial Solutions

Replenish Financial Solutions helps high-income professionals and entrepreneurs create sustainable wealth through passive investing and advanced tax-efficient strategies. With a focus on alternative assets, including real estate, oil and gas, metals, and private funds.

We provide diversification beyond Wall Street, leveraging estate planning, infinite banking, and equity optimization to build durable, values-aligned financial legacies.

Sneha Seth

Managing Partner for Purpose Driven Capital

Sneha Seth has over 20 years of experience spanning finance, operations, and real estate investment. She began her career at KPMG and Ernst & Young before a decade in hospitality operations, and now focuses on commercial real estate, private equity, and operating company investments.

Sneha leads investment strategy, deal underwriting, and portfolio oversight with a hands-on, operator-focused approach.

Pump$ and Pump$

Special Purpose Vehicle

We’ve come together to create Pumps & Pumps, a fund-of-funds structure that serves as a limited partner in Iron Horse Fund I on behalf of our own LPs.

This approach allows more investors to participate in an elite opportunity that traditionally requires a $1M minimum investment.

This is our mission.